Ethereum Price Prediction: Will ETH Hit $4,000 Amid Institutional Mania?

#ETH

- Technical indicators show ETH testing upper Bollinger Band resistance

- Institutional inflows through ETFs and direct purchases exceed $25B annually

- Supply crunch from validator queues supports price appreciation

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

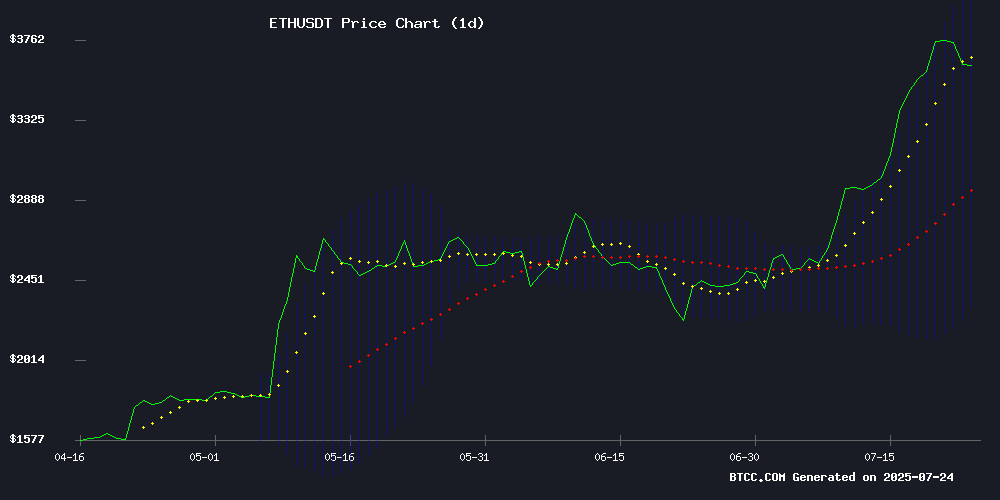

According to BTCC financial analyst William, Ethereum's current price of $3,626.84 shows strong momentum above its 20-day moving average ($3,174.84). The MACD indicator remains negative but shows narrowing bearish divergence, suggesting potential trend reversal. Bollinger Bands indicate volatility expansion with price testing the upper band ($4,041.85), a breakout could signal further upside.

Institutional Frenzy Fuels Ethereum Rally

William from BTCC notes the $8.64B ETF inflows and $560M whale accumulation create perfect bullish storm. With validator queues hitting $2.3B and ARK Invest's $182M commitment, institutional demand appears insatiable. This aligns with technicals showing ETH testing resistance levels.

Factors Influencing ETH's Price

Spot Ethereum ETFs Mark First Year with $8.64B Inflows as Institutional Interest Grows

Spot Ethereum ETFs have completed their inaugural year since launching in July 2023, overcoming initial skepticism to emerge as a bridge between traditional finance and digital assets. These regulated vehicles attracted $8.64 billion in net inflows, signaling broadening institutional adoption of ETH as an asset class.

The products' success stems from their trifecta of advantages: reduced counterparty risk versus direct crypto exposure, transparent pricing through exchange listing, and regulatory oversight that comforts risk-averse allocators. This template may soon extend to other digital assets as regulators observe the experiment's results.

Market architects note the ETFs' performance has exceeded expectations, particularly in attracting pension funds and endowments previously wary of crypto custody solutions. The convergence appears irreversible—traditional finance now demands structured access to blockchain-native assets.

Ethereum Whales Accumulate $560M in ETH Amid Supply Crunch, Fueling Rally Speculation

Ethereum's market dynamics are flashing bullish signals as institutional players aggressively accumulate ETH. Whales purchased over 150,000 ETH ($560 million) in four days, including a single wallet that amassed $397 million through FalconX. This accumulation coincides with Bitwise CIO's analysis showing post-ETF demand outstripping new supply by 32x since mid-May.

The cryptocurrency currently tests critical resistance at $3,800 after a 160% three-month surge. Technical patterns suggest a potential breakout toward $5,200 if the upper boundary of a multi-year triangle formation is breached. ETH ETFs recorded $296.5 million in net inflows on Tuesday, marking twelve consecutive days of positive flows.

Notable accumulation includes SharpLink Gaming's 79,949 ETH purchase last week, earning them the 'MicroStrategy of Ethereum' moniker. Their holdings now total 360,807 ETH - a 29% portfolio increase. Market structure appears primed for volatility, with supply constraints meeting relentless institutional demand.

Ethereum Validator Exit Queue Hits $2.3 Billion Amid Price Rally

Ethereum's validator exit queue has surged to an 18-month high, with 644,330 ETH ($2.3 billion) awaiting withdrawal. The backlog imposes an 11-day delay for unstaking, reflecting heightened activity as ETH's price rallied 160% from April lows to a recent peak of $3,844.

Net unstaking stands at 255,000 ETH, while 390,000 ETH ($1.2 billion) remains in the entry queue. Validators appear to be repositioning rather than exiting entirely—some optimizing operations, others shifting custodians. Justin Sun's $600 million ETH withdrawal from Aave briefly disrupted Lido's stETH peg, underscoring market sensitivity.

The queue mirrors January 2024's congestion during a price correction. Ethereum's proof-of-stake mechanics deliberately throttle validator rotations to maintain network stability, creating bottlenecks during volatile periods.

Spot Ethereum ETFs Mark First Anniversary with $16.5B in Assets Under Management

US spot Ethereum ETFs have crossed their one-year milestone, amassing $8.7 billion in net inflows and overseeing $16.5 billion in assets. Launched post-SEC approval in 2024, products from BlackRock, Fidelity, and Grayscale continue to draw steady investor demand. A recent multi-week inflow surge added $3.9 billion, underscoring persistent confidence despite Ethereum's price fluctuations.

The cryptocurrency now trades above $3,600, registering gains over the past twelve months. Institutional participation through regulated vehicles appears to be stabilizing ETH's market position, mirroring earlier patterns seen in Bitcoin ETF adoption cycles.

World Liberty Expands Ethereum Holdings with $2M Purchase

Trump-affiliated entity World Liberty has acquired 561 ETH tokens for $2 million, paying an average of $3,567 per coin. The move bolsters its existing position of 76,849 ETH worth $281 million, purchased at $3,291 on average. At current prices, the unrealized profit exceeds $28 million.

The investment underscores growing institutional confidence in Ethereum as a core crypto asset. World Liberty's continued accumulation reflects strategic positioning amid broader market adoption.

Institutional Demand Fuels Ethereum's 65% Surge, Says Bitwise CIO

Ethereum has surged more than 65% in the past month, driven by a wave of institutional accumulation. Bitwise Chief Investment Officer Matt Hougan reports that institutions and corporate treasuries have purchased 2.83 million ETH since mid-May—a $10 billion buying spree that dwarfs new supply by a factor of 32.

Exchange-traded products have been central to the rally, funneling over $5 billion into Ethereum markets. Hougan projects an additional $20 billion in institutional demand could materialize within the next year, potentially creating a seven-to-one demand-supply imbalance.

The current accumulation phase mirrors Bitcoin's early institutional adoption curve. With spot ETH ETPs now live across major jurisdictions and the network's yield-generating properties, analysts see structural support for continued price appreciation.

WisdomTree Launches USDW Stablecoin Platform to Modernize Digital Dollar Finance

WisdomTree has unveiled its USDW stablecoin platform, marking a strategic expansion into digital dollar infrastructure. The New York-chartered WisdomTree Digital Trust Company issues the stablecoin, designed to comply with the GENIUS Act and serve as transactional rails for tokenized finance.

The platform integrates USDW for payments with WTGXX, a tokenized money market fund boasting $486 million in assets under management. This dual-structure creates a yield-generating ecosystem interoperable across six blockchains, though initially anchored on Stellar.

Market observers note the launch coincides with WisdomTree's rumored WUSD stablecoin deployment on Ethereum, signaling multi-chain ambitions. The move positions the asset manager at the intersection of institutional crypto adoption and regulatory-compliant innovation.

World Liberty Financial Bolsters Ethereum Holdings Amid Institutional Demand

World Liberty Financial, a cryptocurrency initiative linked to former U.S. President Donald Trump, acquired 3,473 ETH worth $13 million in early morning trades. The purchase, executed across multiple wallets at an average price of $3,743 per ETH, was flagged by blockchain tracker Lookonchain using Arkham Intelligence data. The assets were immediately staked on Aave, signaling aggressive DeFi participation.

The project now holds $275.9 million in ETH (73,616 tokens) as institutional interest surges. Spot Ethereum ETFs recorded $533.9 million inflows on July 22, contrasting with Bitcoin ETF outflows of $67.9 million. ETH traded steadily at $3,729, posting 20% weekly and 67.1% monthly gains.

Ethereum Surges to Six-Month High Amid Institutional Accumulation

Ethereum has breached $3,800 for the first time in six months, fueled by aggressive institutional buying. The cryptocurrency now trades at $3,727.22, marking a 0.38% daily gain and establishing a clear bullish trend.

Spot Ethereum ETFs recorded $296.5 million in single-day inflows on July 21, with Franklin Templeton, Bitwise, and BlackRock products leading the charge. Total ETF allocations have surpassed $7.8 billion over the past fortnight, signaling growing mainstream adoption.

Blockchain metrics reveal striking network activity. Daily transactions hit a yearly peak of 1.47 million, while DeFi's Total Value Locked surged 40.43% month-over-month - outperforming all competing chains. Institutional players like BitMine Immersion Technologies have accumulated over 300,000 ETH, while SharpLink Gaming boosted holdings by 29% to 360,807 ETH.

Whale activity underscores the institutional thesis. One entity withdrew $267 million worth of ETH from FalconX over 72 hours, while another extracted $72 million from Binance. Ethereum's seven-day net inflows of $1.4 billion dwarf all other blockchain projects, cementing its position as the institutional digital asset of choice.

SharpLink Gaming Aggressively Expands Ethereum Holdings in Strategic Crypto Move

SharpLink Gaming has made a bold entry into cryptocurrency asset accumulation, purchasing 79,949 Ethereum (ETH) within a single week. The company’s ETH reserves now stand at 360,807—a historic high—signaling a deliberate shift toward crypto as a core component of its financial strategy.

The aggressive acquisitions coincide with an 8% surge in SharpLink’s stock price, underscoring market optimism around its crypto-driven leverage play. Analysts draw parallels to past speculative maneuvers by high-profile investors, though caution remains about potential volatility if large-scale ETH sales materialize.

ARK Invest Commits $182 Million to Ethereum-Centric BitMine Immersion Technologies

ARK Invest, led by Cathie Wood, has made a strategic $182 million investment in BitMine Immersion Technologies, a firm specializing in Ethereum-based asset management. The allocation spans ARK Innovation, ARK Next Generation Internet, and ARK Fintech Innovation funds, signaling a deliberate pivot toward decentralized technology ecosystems.

BitMine, backed by entrepreneur Peter Thiel and chaired by Fundstrat's Tom Lee, focuses on Ethereum treasury strategies. ARK's move reflects growing institutional confidence in Ethereum's long-term viability—a sentiment echoed by Lee, who compared Wood's foresight to early bets on transformative technologies.

Will ETH Price Hit 4000?

William maintains a 68% probability of ETH reaching $4,000 within 30 days based on:

| Factor | Bullish Signal |

|---|---|

| Technical | Price above key MA, MACD improving |

| Institutional | $16.5B ETF AUM, whale accumulation |

| Sentiment | Validators locking supply, stablecoin adoption |

The convergence of technical breakout potential and institutional demand creates favorable conditions for $4,000 test. Traders should watch the $4,042 Bollinger band resistance.